The air is thick with anticipation, isn’t it? Like waiting for the first monsoon shower after a scorching summer. The Reserve Bank of India (RBI) has dropped a few hints – subtle, almost coy, but undeniably there – about a potential rate cut in December. But, as always, the devil’s in the details. It’s not just about whether it happens, but why it matters to you, the average Indian.

Why a Rate Cut Matters | Beyond the Headlines

Let’s be honest: economics can feel like a foreign language. But here’s the thing: a rate cut is like a shot of adrenaline for the economy. It essentially means that borrowing money becomes cheaper. Banks can offer loans at lower interest rates, making it more attractive for businesses to invest and for individuals to spend. The goal? To stimulate economic growth.

But the “why” goes deeper. India’s economic growth hasn’t been firing on all cylinders lately. Global headwinds, fluctuating oil prices, and domestic factors have all played a role. A repo rate cut could be the lever the RBI uses to nudge things in the right direction. Think of it as a carefully calibrated intervention to boost demand and investment. The impact will be felt across various sectors.Interest ratesinfluence things from your home loan EMIs to the profitability of businesses.

Decoding the RBI’s Signals | What Are They Really Saying?

The RBI doesn’t just come out and shout, “We’re cutting rates!” Instead, they use carefully chosen words in their policy statements. They might say something like, “The current macroeconomic situation warrants a more accommodative stance.” Translation: we’re leaning towards lower rates. They might also point to moderating inflation or sluggish industrial growth as justification. What fascinates me is how much weight the RBI gives to global economic conditions these days. We’re no longer an isolated island; our monetary policy is intrinsically linked to what’s happening in the US, Europe, and China.

But, there’s always a ‘but,’ isn’t there? The RBI also has to consider the potential downsides of a decrease in interest rates . Lower rates can fuel inflation if demand outstrips supply. They can also put downward pressure on the rupee. So, it’s a balancing act – a high-wire performance with the Indian economy hanging in the balance.

Impact on Your Wallet | How the Rate Cut Affects You Directly

This is where it gets personal. How does a reduction in interest rates impact your day-to-day life? Well, if you have a home loan, car loan, or any other type of loan, you could see your EMIs decrease. That’s extra money in your pocket each month. Businesses might be more inclined to invest in expansion, creating more jobs. The stock market could also react positively, boosting your investment portfolio.

However, savers might see lower returns on their fixed deposits and other savings instruments. It’s a mixed bag, depending on your financial situation. For many middle-class families, a bit of relief on loan payments can be a game-changer. It can free up funds for other essential expenses or even allow for a little bit of discretionary spending. That extra spending, multiplied across millions of households, can provide a significant boost to the economy. GDP growth depends a lot on people’s spending.

Navigating the New Landscape | What Should You Do?

So, the RBI might cut rates in December. What do you do with this information? Don’t panic! Instead, take a deep breath and assess your financial situation. If you’re planning to take out a loan, now might be a good time to start shopping around for the best rates. If you’re a saver, consider diversifying your investment portfolio to include assets that can generate higher returns than traditional fixed deposits.

Consider, too, that a rate cut doesn’t happen in isolation. It’s part of a larger economic picture. Keep an eye on inflation, global economic trends, and government policies. The more informed you are, the better equipped you’ll be to make sound financial decisions.

The Global Context: Why India’s Monetary Policy Matters Worldwide

Let’s zoom out for a moment. India is not just an economy; it is a major player on the global stage. What happens with the Indian economy sends ripples through the rest of the world.

When the RBI makes a move on rates, international investors take notice. A rate cut can make Indian assets more attractive to foreign investors, leading to increased capital inflows. But it can also signal concerns about economic growth, potentially triggering capital outflows.

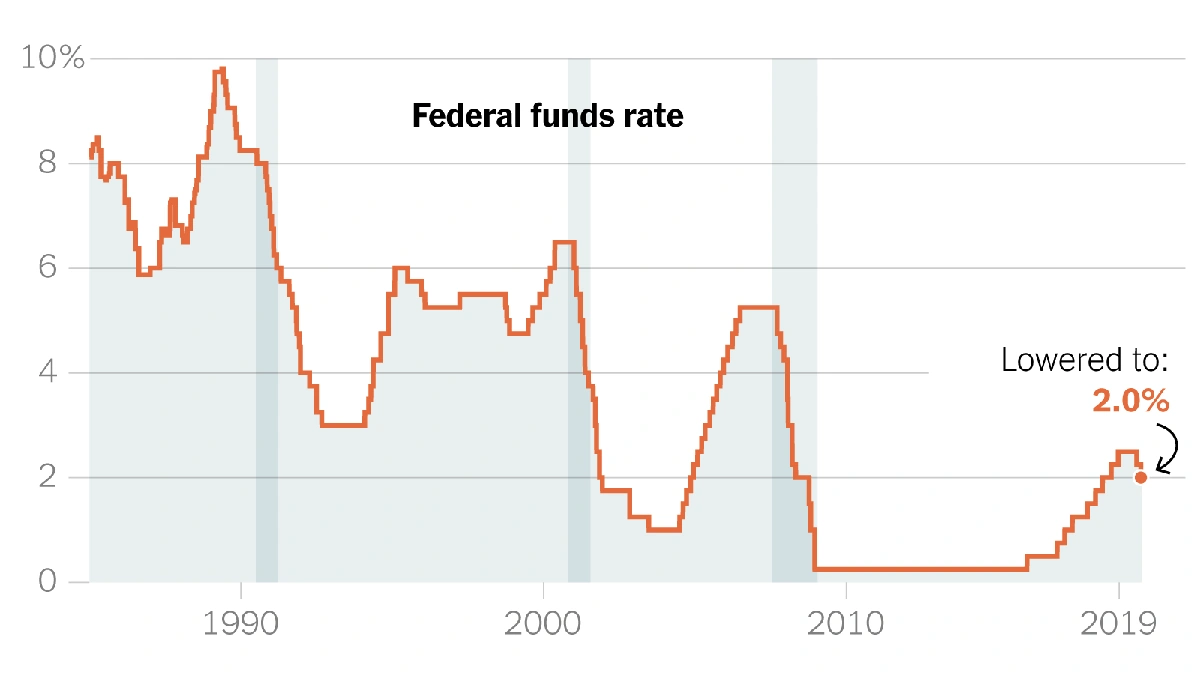

The relationship between India and the rest of the world is intricate. For example, let’s say that the US Federal Reserve has recently raised its interest rates. This might create pressure on the RBI to keep its rates relatively high to prevent capital from flowing out of India. That’s one reason why the RBI’s decision-making is such a complex process. As per the latest reports, the decision regarding the rate cuts is a very tough call. But it can be a sigh of relief for many. Check out more insights here .

FAQ | Decoding the Rate Cut Mystery

Frequently Asked Questions

What exactly is the repo rate?

The repo rate is the interest rate at which the RBI lends money to commercial banks. It’s a key tool the RBI uses to control inflation and manage the money supply.

How quickly will I see a reduction in my loan EMI after a rate cut?

It depends on your bank and the terms of your loan. Some banks pass on the benefits of a rate cut immediately, while others may take a few months.

What if I have a fixed-rate loan? Will I benefit from a rate cut?

No, fixed-rate loans are not affected by changes in interest rates. However, you could consider refinancing your loan to take advantage of lower rates.

Could a rate cut lead to higher inflation?

Yes, a rate cut can potentially lead to higher inflation if it stimulates demand too much. The RBI has to carefully balance the need to boost growth with the need to keep inflation under control. Lower interest rates means more liquidity in the market which may lead to higher inflation.

Is a rate cut always good news for the stock market?

Not always, but it often is. Lower rates can make it cheaper for companies to borrow money and invest, which can boost their profits and stock prices. However, the stock market is also influenced by many other factors, such as global economic conditions and investor sentiment.

Ultimately, the RBI’s decision on rates will depend on a complex interplay of factors. But one thing is certain: it will have a significant impact on the Indian economy and on your wallet. Stay informed, stay vigilant, and don’t be afraid to ask questions. The world of economics might seem complicated, but it’s also fascinating – and it affects us all.